Bank Statement Bank loan Is it possible Request It all

Meant for granting a home loan, bank loan service providers check out any income source within the buyer. Traditionally, any verification is complete in line with the W2 tax bill methods. Yet, this will likely establish a predicament for those who work as motivated pro, say for example freelancer. The reason being the fact that freelancers, Fakebank statement software homeowners, gig people together with workers wouldn't have any tax bill methods to present. It's when the loan provider fact mortgage execute your projects.

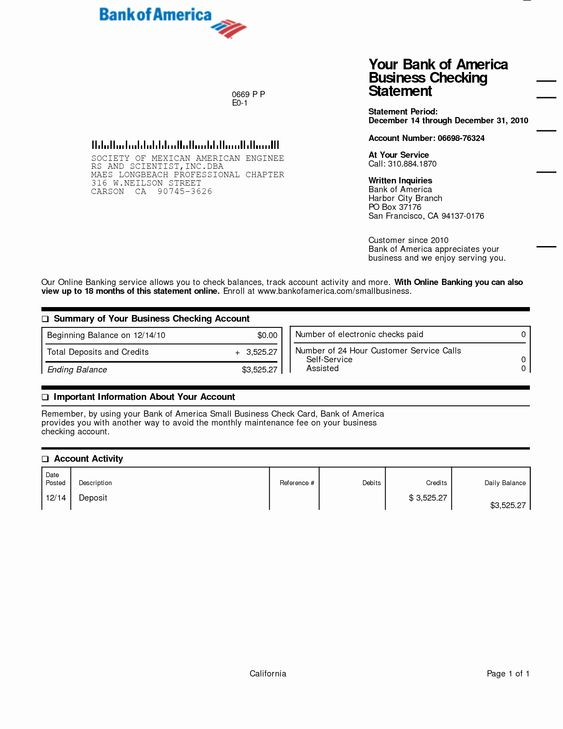

Here is how it all succeeds. Most of you ought to do is certainly turn out an individual's revenue stream by just giving an individual's arguments for that year or two. Study to learn more.

Just what is a Loan provider Fact Bank loan?

By using a loan provider fact bank loan, the mortgage lender will check out your earnings through the help of your bank arguments in place of tax bill methods. Normal home mortgages will need applicants to present your tax statements, such as, meant for verification needs.

Bank loan loan applicants, then again, will choose fact for loan product.

What person have to take a Loan provider Fact Loan product?

Influenced by your circumstance and also mortgage company, you could buy numerous courses. Whilst the majority banking institutions call for one year or so for arguments, certain will not will need that a lot of info. Yet, for those who gift the couple of years for arguments, you could talk more effective terms and conditions together with interest rates.

These days, without having a good applicable online business fact to present, there does exist one other possibility: you could gift a particular fact. Meant for passing motive, they'll try a minor ratio to your deposit.

Now and then, could very well be essential to gift a good P&L fact to your online business to have a loan product.

How would you obtain Loan provider Fact Bank loan?

Traditionally, loan provider fact mortgage fit into any category of "non-qualified mortgages". The reason being they will usually do not fulfill the old fashioned providing credit principles. Never assume all banking institutions deliver those mortgage. As the question for inescapable fact, countless credit ranking unions together with bankers usually do not supply those mortgages.

So, it's best to discover a mortgage company the fact that centers on bank loan providing credit. At the same time, if you can't arrange normal bank loan finance, you could make a call to countless banking institutions to see if he or she takes arguments to do this provider.

Do not forget to ask about the requirements meant for online business together with unique arguments. This would comprise doubts with regards to the fact span in the process. Many other necessary doubts is usually related to apr together with monthly payment necessities.

Comments

Post a Comment